Modernising Protection

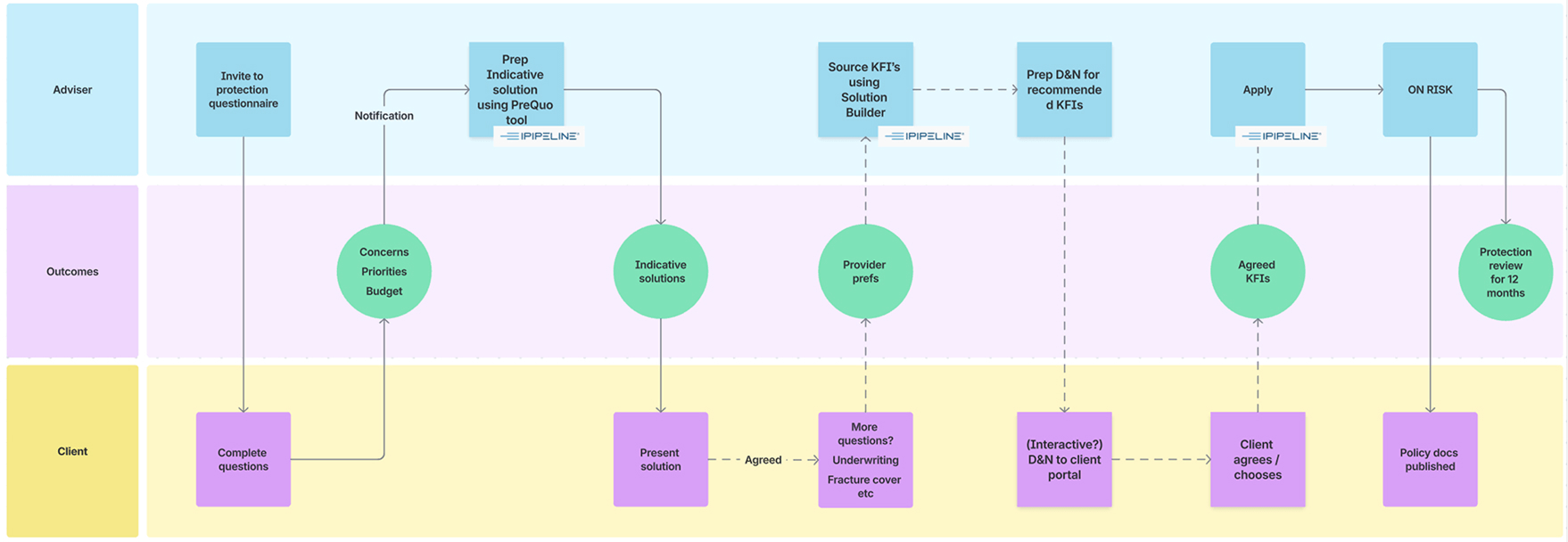

Workflows

A strategic overhaul of the insurance sales journey, moving from a manual, high-friction process to a "Zero Touch" automated model.

The Target

132 "Zero Quoters"

Projected Impact

£109k Gross Profit

The Solution

Zero Touch API Automation

1. The Friction of "Double Keying"

The biggest barrier to adoption was manual effort. Advisors had to type client data into the mortgage system, and then type it again into the insurance system. This redundancy caused 57% of potential quotes to be abandoned. We mapped the flow to identify exactly where the data hand-offs were failing.

Initial process mapping identifying data redundancy points.

The Regulatory Shift: "Affordability Led"

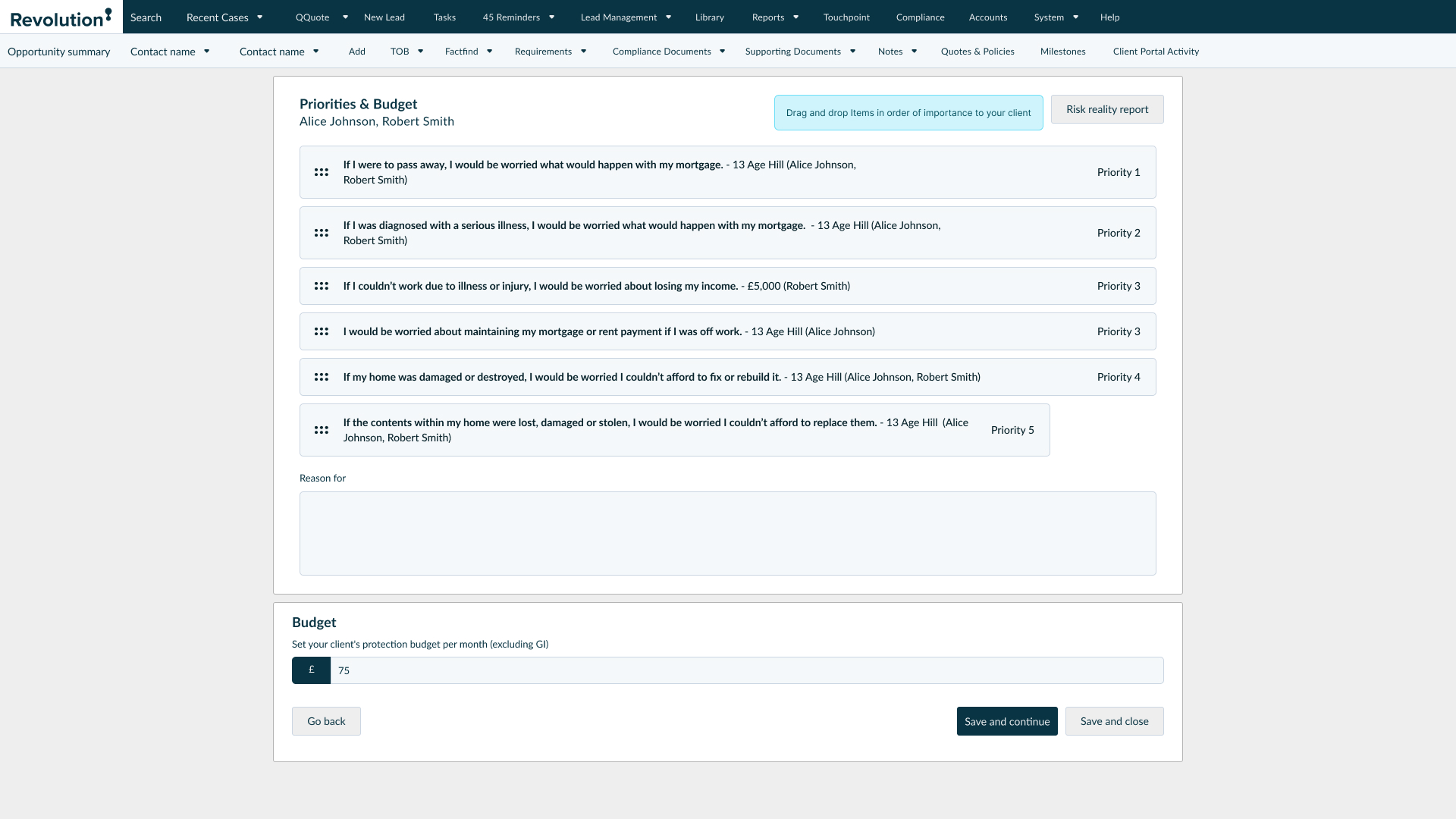

The project was underpinned by a major change in Protection Advice Standards (PAS). We had to move the system from a rigid "All or Nothing" model to a flexible, client-centric approach.

Old Standard (2024)

Must Recommend "Full Cover"

Advisors were forced to quote for the full mortgage debt. This resulted in high premiums that clients rejected immediately.

New Standard (2026)

Wishes & Preferences

Recommendations are now driven by client budget. Advisors can document the "gap" without penalty, increasing conversion on affordable policies.

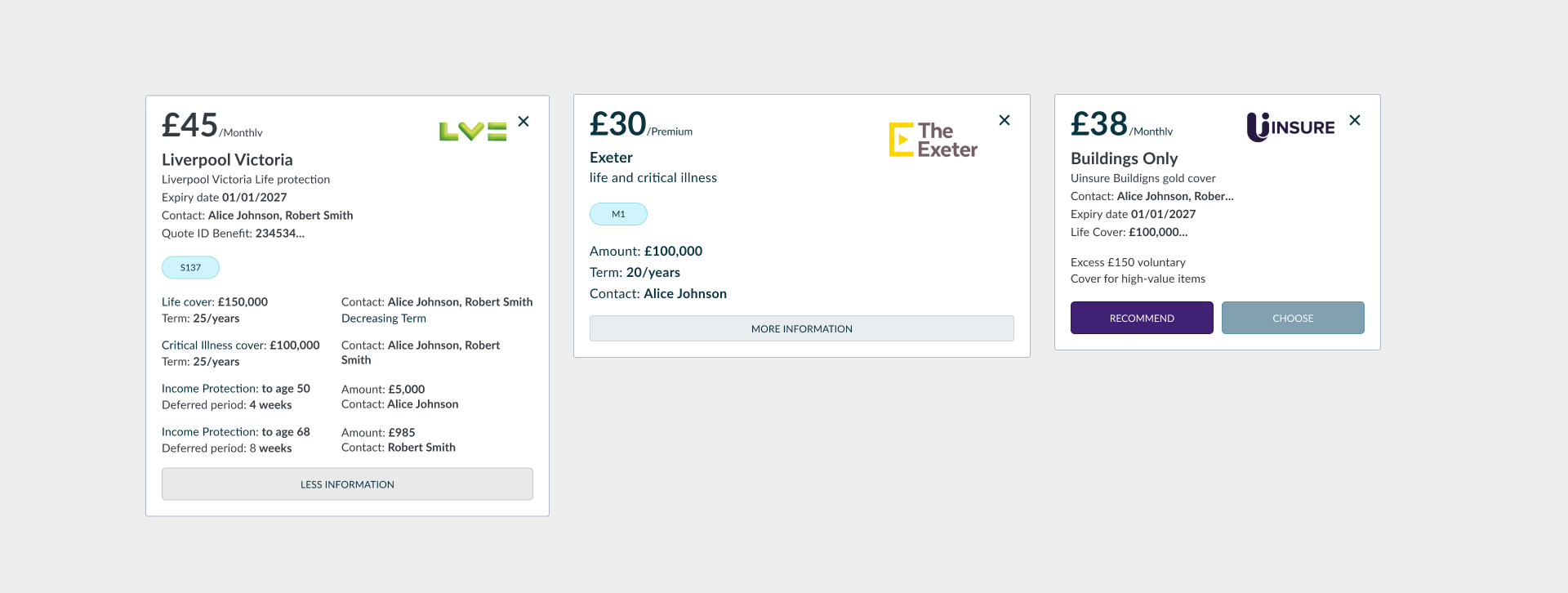

2. "Zero Touch" Sourcing

To solve the friction, we implemented an API-led integration. When a mortgage application moves to "Submitted," client data is automatically validated and sent to sourcing partners (Uinsure/LV). This creates an instant quote without a single keystroke from the advisor.

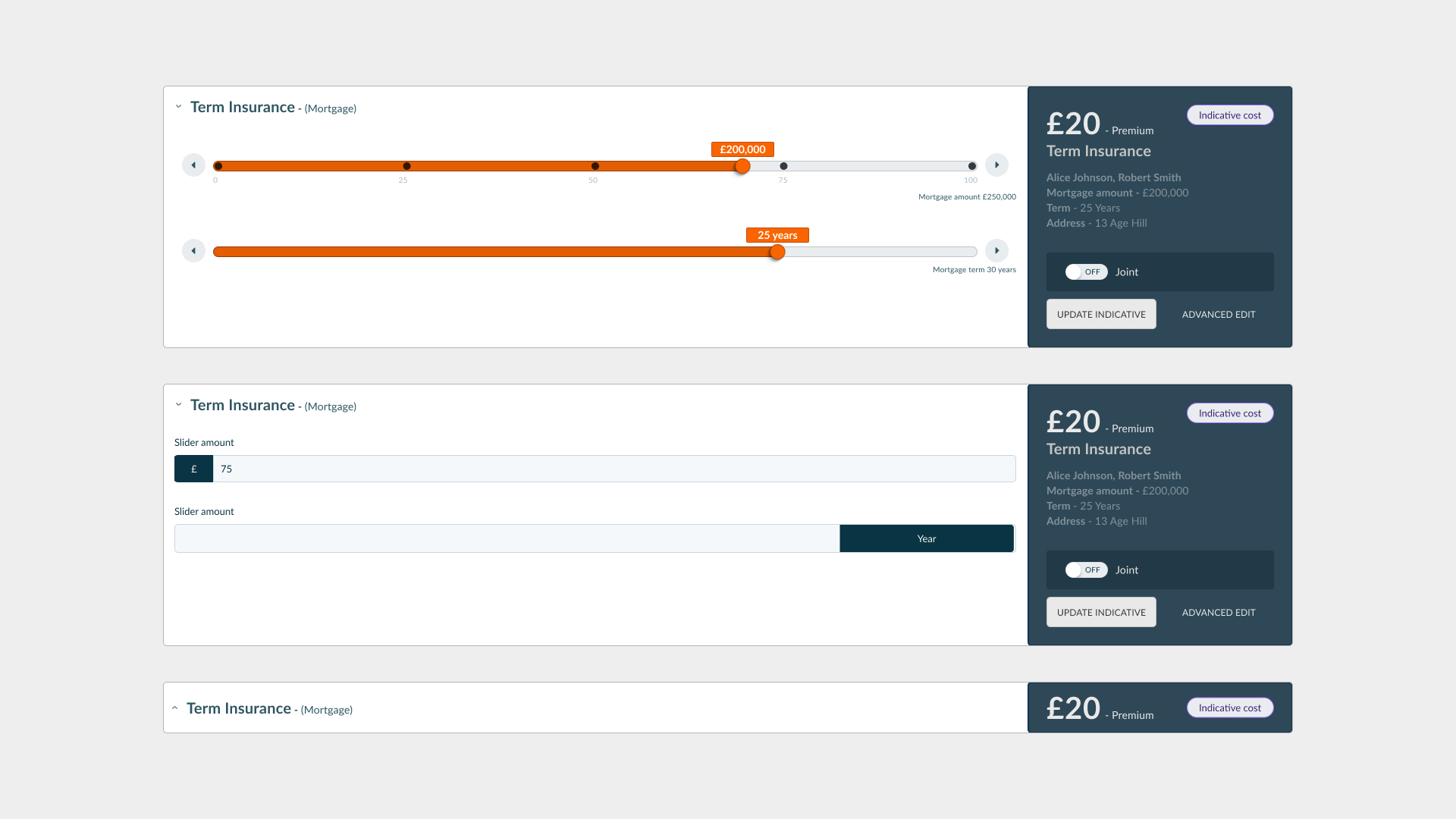

3. Designing for "Live Tuning"

Traditionally, changing a quote meant re-submitting a form. I designed an "Equaliser" interface using interactive sliders. Advisors can now adjust Net Monthly Income or Mortgage Term live with the client to see premiums update instantly.

.jpg)

The "Equaliser" view allowing rapid adjustment of cover terms.

Detail: Interactive range sliders.

Detail: Dynamic quote cards that update instantly.

4. Transparency First: The Budget Slider

Advisors often waste time generating quotes that clients can't afford. We introduced a "Budget First" approach. By setting a monthly cap before sourcing, the system filters out unrealistic options.

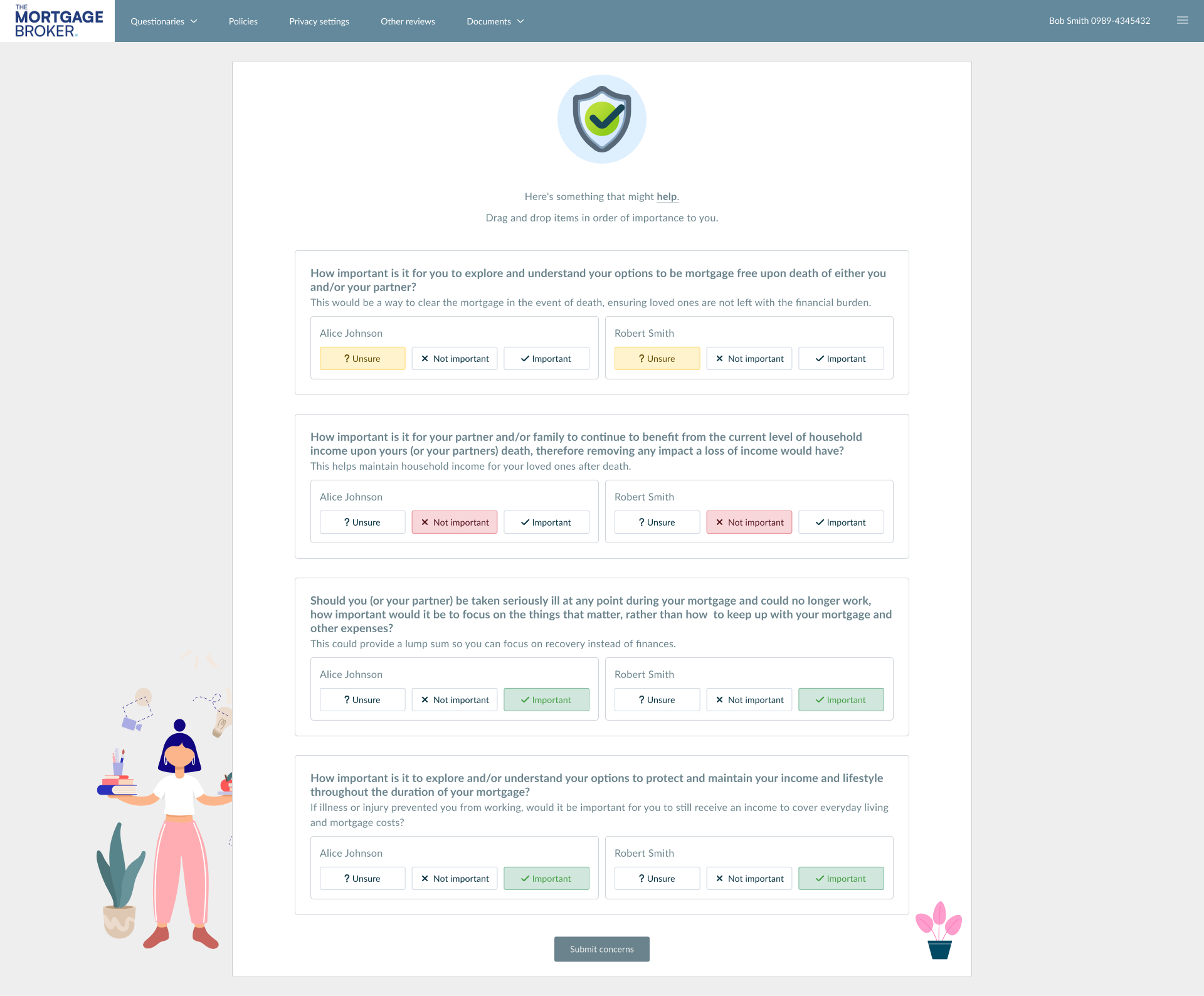

5. Adaptive Question Sets

We recognized that not every client needs the same depth of interrogation. The system now supports variable question sets: a Comprehensive version for deep-dive compliance and a Shorter version for standard cases. This flexibility allows advisors to match the process to the client's specific context.

Full Question Set: For detailed risk assessment.

Short Version: Reduced set for efficiency.

The "Include in D&N" Confusion

Problem: During UAT, users were confused by a button labeled "Included" that, when clicked, would exclude the item. The status text conflicted with the action.

Solution: We moved from a state-based button to a Toggle Switch pattern. This separated the label ("Include in Demands & Needs") from the state (On/Off), reducing cognitive load and error rates in compliance documentation.

6. Smart Disclosure Logic

We replaced manual "guesswork" with a logic matrix. This maps natural language concerns directly to technical outcomes, ensuring the generated Demands & Needs letter is accurate and compliant automatically.

| Client Concern | Product Output |

|---|---|

| "Ensure mortgage is paid off if I pass away." | Life Insurance |

| "Medical expenses covered for serious illness." | Critical Illness |

| "Replace lost income if I can't work." | Income Protection |